THE LAB #9: Scraping OpenSea NFT's data

Getting winners and losers of the Bored Ape Yacht Club collection transactions

The NFT hype cycle

Welcome back to The Web Scraping Club for a new episode of The Lab. In the past week, a scandal that involves the famous influencer Logan Paul and his crypto project called “Criptozoo” exploded, thanks to the Cofeezilla investigations (you can see the full story here). Basically, it seems that this crypto game has never been delivered for multiple factors but people, trusting the public profile of Logan, put several million USD into it, hoping to have some return, a thing that never happened. It’s nothing new under the Crypto sun, Ponzi schemes promising impossible returns on investments are discovered every day, and surprisingly there’s always someone who got caught in the fishnet.

But this is not a post about scams, only this story reminded me of an ancient word, coming from a far era from the past, called NFT. Do you remember? Funky images with some traits hardcoded in a smart contract, exchangeable like trading cards on marketplaces like OpenSea?

It was the buzzword of 2021, the year well-known for 2 plagues: Covid-19 and the explosion of Crypto gurus that have just left the ICO (another forgotten term) bandwagon, just to hop in the NFT one.

As you can see from this Google Trends chart, the interest is sharply fading away, but during the whole of 2021, the web was full of news and stories about NFTs and new collections launched.

One of the most well-known NFT collections is called “Bored Ape Yacht Club”, consisting of ten thousand “Bored Monkeys” images procedurally generated by an algorithm. In May 2021 the launch price for every NFT was 0.08 ETH, approx 200$, and they went sold out in 12 hours. In October they were already exchanged for hundreds of thousands each, quickly becoming a status symbol. They give access to a Discord server where talk with other owners, even celebrities that bought them, and a private section of the collection website.

Yuga Labs, the company behind the BAYC NFTs, in March 2022 raised 450M USD in funding by venture capital firm Andreessen Horowitz, with a company evaluation of 4 Billion USD.

But when the music stops…

As we have seen many times in different cases when things go up so fast, usually go down even faster. Having a look at the Google trends chart, now the hype is gone and the interest in NFTs, in general, is almost faded away. We can also see it from the OpenSea activity dashboard, where the number of sales for the Bored Apes NFTs went from several hundred per day in early 2021 to a few tenths of the latest months.

To make things worse, the whole crypto economy is passing through a so-called “crypto winter”, with all the major cryptos losing around 70% of their price from their highest peak.

I’ve always been fascinated by this world and its dynamics and thanks to the transparency given by the blockchain and the web scraping techniques we’ll see later in this post, I wanted to put down some numbers.

Basically, I’ve tracked down every sale of Bored Ape NFTs that happened on OpenSea from the start to enrich the stats of the collection available on the marketplace.

2 billion USD

That’s the amount of real money moved by The Bored Ape Yacht Club, from May 2021 to the first days of December 2022.

Yes, 2 Billion USD, like the yearly GDP of the whole Central African Republic. Summing up the USD value (at the time of the transaction) of all the sales that happened, you get $2,121,310,433 USD, with an astonishing peak of 283 Million USD traded during only January 2022.

Winners and losers

In a market that had such a hyped start and a sharp decline, who entered first and had the right timing when selling, had a huge advantage.

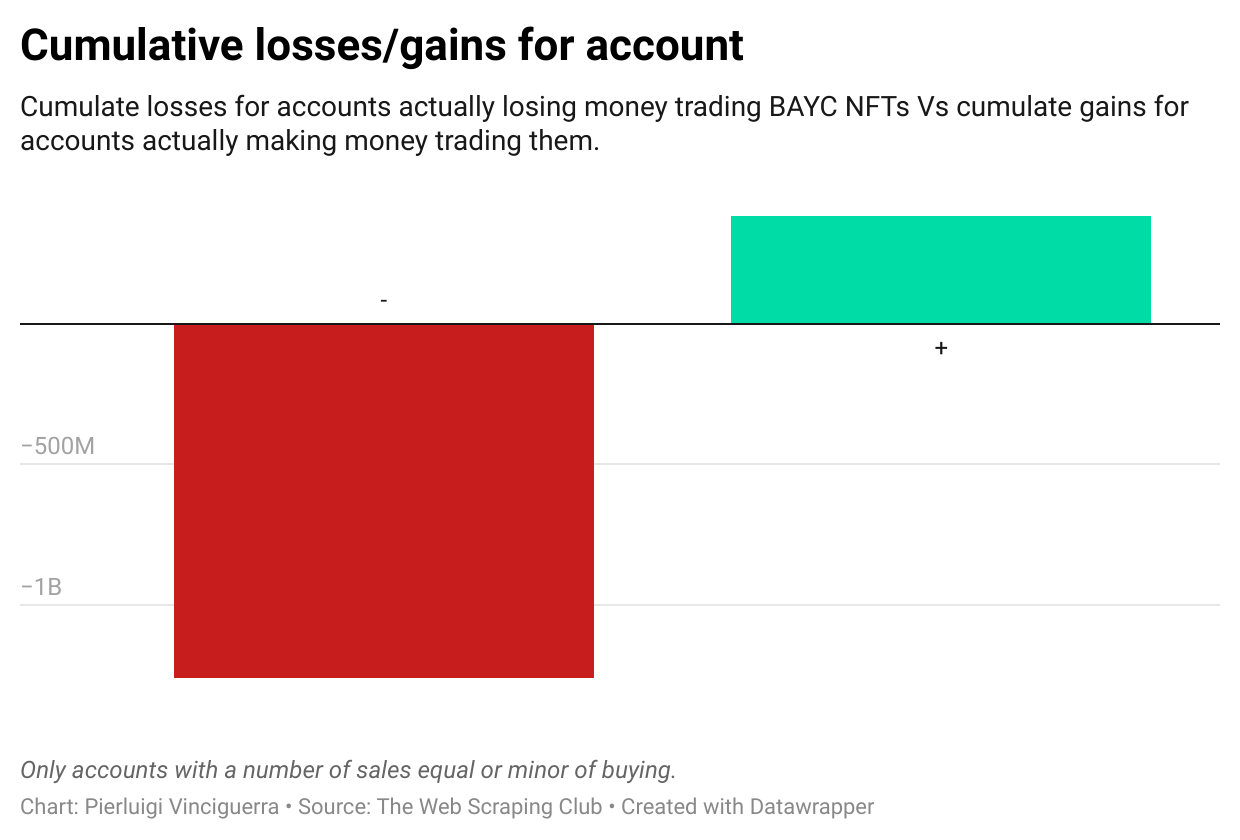

If we do not consider the first-movers, who got their prize in pre-sale, around ten thousand accounts on Opensea are involved in trading these BAYC NFTs. Around 70% of them lost some money, accumulating a loss of 1.2 Bn USD. On the other hand, the remaining 30% cumulated a gain of 380 Mn USD.

But if we consider only the accounts that sold more NFTs than bought, if they bought any, they made around 900Mn USD in gains.

As a result, we have a massive shift of wealth (around 1.2 Bn USD) from 7k accounts to another 7k, and half of the latest probably bought the NFTs during pre-sale.

130 vs 127

Another interesting fact that emerges from the transaction data is that 130 accounts made more than 1 Mn USD in trading, while 127 lost more than 1 Mn USD.

One of the top performers is the famous NFT collector Pransky who made alone 5.5 Mn USD by selling 1155 NFTs and buying only one for 1.5 Mn.

With all the buzz and noise around the NFTs, and in particular around The Bored Ape Yacht Club NFTs, it surprises me I haven’t seen these numbers in any article I’ve read. The main reason I suppose is that getting them requires a simple but not effortless job of web scraping, both on OpenSea and on Etherscan to get the USD value of the transaction at that time.

And that’s what we’ll see in the next chapters, the scrapers I’ve created to get this data.